November Market Analysis

Happy Monday!

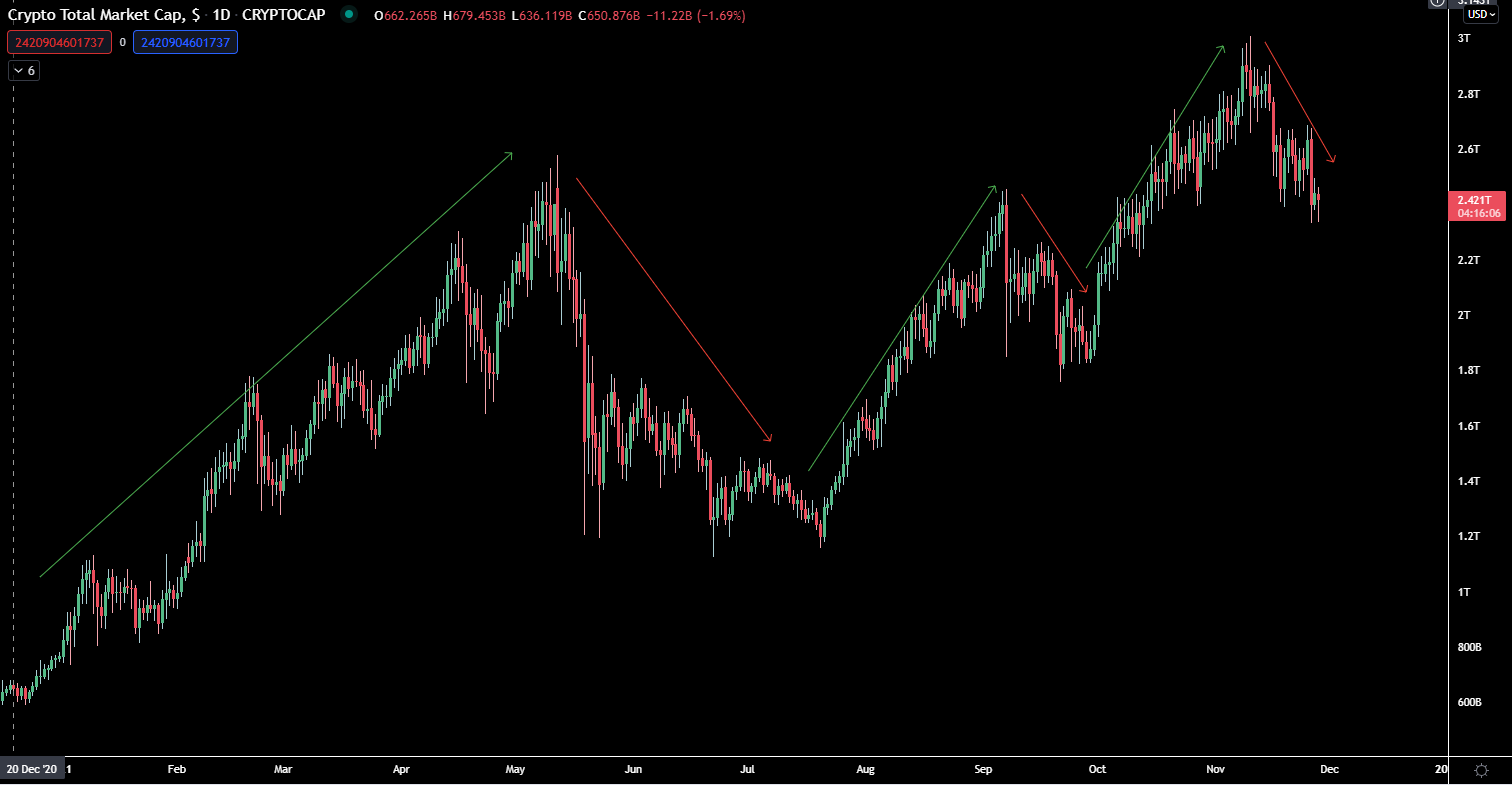

Three steps forward, two steps back has been the name of the game for Bitcoin and crypto this whole year. Let’s take a look at the Total market cap chart – an index for the entire industry.

You should be able to see here clearly the “three steps up, two steps down” pattern that we have been in since the beginning of the year. From January to May crypto as a whole more than tripled in market cap, before experiencing a sharp correction from May to July. Then from August to September we took another leap forward, recovering to the market capitalization highs we saw in May. Most of September was spent “stepping back” again, before an extremely strong October that took crypto market cap to new highs close to $3 trillion. November has been another corrective “step back” month so far.

The point is this is nothing out of the ordinary for a positive bull market trend. Crypto is volatile, and we should never expect gains to follow a straight line. If you get stressed from these extended “step back” moves, you should consider taking some off the table when the market is showing strength. The importance of minimizing stress while investing cannot be overstated.

In terms of fundamentals, new Bitcoin wallets holding at least 0.01 BTC hit a new all-time-high at over 9 million unique addresses. At the same time, Bitcoin transaction fees have been coming down as scalability solutions, such as the recent Shnorr Signature upgrade, are implemented. This paints a bullish picture for the Bitcoin network.

Meanwhile, Ethereum recently passed 1 million coins burned since EIP-1559 went live this summer.

Ethereum is currently attempting to hold the $3900-$4000 price level. I think if it can successfully hold here, we could see a strong advance to end Q4/begin Q1.

As I always say, I do not know what lies ahead. The macro picture (across all asset markets) is murky. Interest rates are at record lows while inflation is at record highs. The housing market is red hot, but starting to show signs of weakness. Same with the stock market. The new Covid variant has given some reason to pause. Crypto is still a risky asset class and if the historic rally in asset prices were to reverse, it will not be spared.

That said, the pace of innovation in this industry remains unlike anything I have ever seen. I know there is real value being created, behind a new cohort of artists, creators (I outlined a few weeks ago), and major brands. If crpto.com was willing to spend $700 million for the naming rights to LA Staples Center, well that’s one heck of a vote of confidence at the very least.

Crypto News:

Citi Plans to Hire 100 Staffers for Beefed-Up Crypto Division (LEARN MORE)

NFT Music Platform Royal Closes $55M Funding Round Led by A16z (LEARN MORE)

El Salvador Buys 100 More Bitcoins as Crypto Market Falls (LEARN MORE)

Hackers Are Attacking Cloud Accounts to Mine Cryptocurrencies, Google Says (LEARN MORE)

Have a great week!

Shahar

This newsletter is meant for informational purposes only. It is not meant to serve as financial advice. If you are interested in financial advice, please schedule a personal consultation with me, and be sure to read the accompanying disclaimer.